Fighting and Winning Insurance Denials

Insurance companies benefit whenever you don't fight, so here's how to fight smart.

Insurers have a very strong incentive to not pay out claims, they want to hold on to as much of the premium as possible and want to direct as much of the premiums as they can into their related family of companies to continue to keep a high overall share of margin through vertical integration (page 8 on this FTC report gives a good visual overview). A recent KFF analysis based on 2023 data found, on average, insurers denied 1-in-5 claims.

Seeing that didn't surprise me, the number of reports on denial rates and lawsuits over excessive denials has been a consistently growing drum-beat with United, Cigna, and Humana all facing lawsuits recently over excessive denials with inadequate human review.

The statistic that concerns me even more though is that consumers appealed denials less than 1% of the time. Given the tendency to err on the side of denial, and given appeals succeed almost half the time (44%), millions of claims remain uncorrected.

Why not appeal?

As someone who's gone through several insurance appeals in my lifetime, and 3 appeals in just the last year, I get why most people don't appeal. Most times, insurance looks like it's done something. You'll often see a negotiated rate on explanation of benefit documents. For those less savvy, it may not be obvious that these negotiated rates aren't the same as a payment from the insurer.

Seeing this, combined with the insurer possibly paying for some of the claimed items and not for others, could lead the reader to thinking they got some value from their healthcare plan and not feel the need to fight over the remaining amount. This can be especially true if the amounts are small.

Where a provider directly bills insurance (as is common with dental services and services that collect payment immediately), you're also told pretty convincingly directly by your doctor's office how much you owe, and you might feel that if anyone would know the amount you owe, they would.

It also feels like something that will take a lot of time. Insurances companies are notoriously hard to get a hold of, and the prospect of spending time on hold when you could do literally anything else is obviously not appealing.

That said, what I want to convince you of today is that making an insurance appeal can be low effort, not require a lot of your time, and is often successful. It's also a no-lose scenario, as if you spend a few minutes appealing and you don't succeed, the worst that happens is you still have the same bill. There's essentially nothing to lose, aside from getting benefits you're owed.

Understanding your explanation of benefits (EOB)

Whenever you use your insurance (even when they don't pay for something), it will generate an explanation of benefits. Sometimes you'll get one even before you receive a service as part of a pre-authorization. Depending on your insurer, you'll either get it directly in the mail, get it in an only portal, or both.

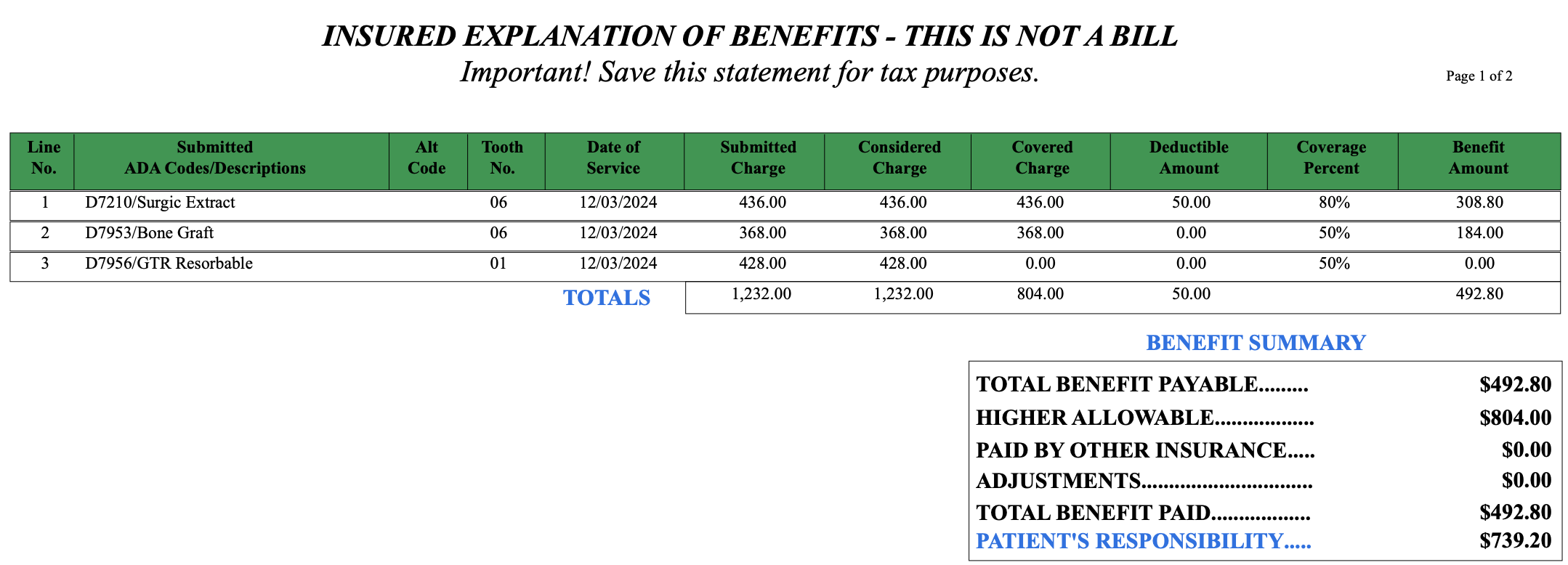

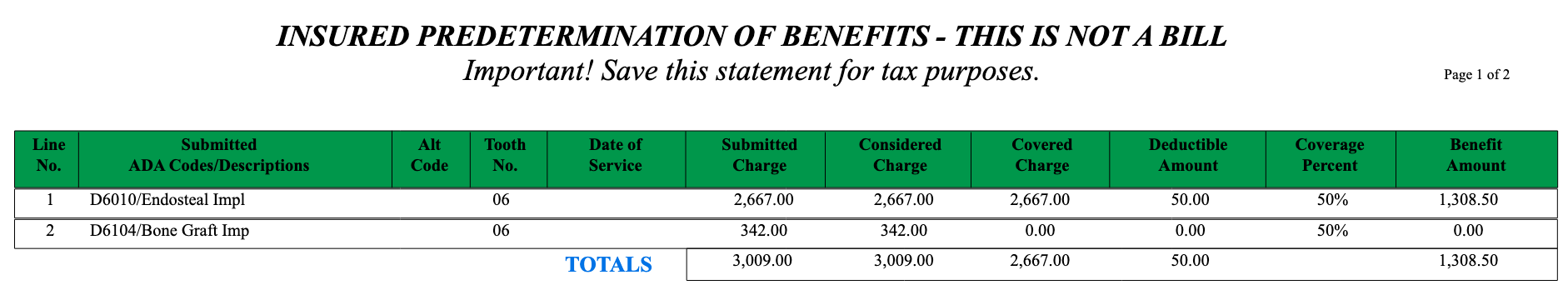

If you look at FIG 2 above, you'll see a pretty typical EOB for a dental claim. Below this table is a "Remarks" section that includes the insurers' reasons for denying this line item in my dental surgeons claim:

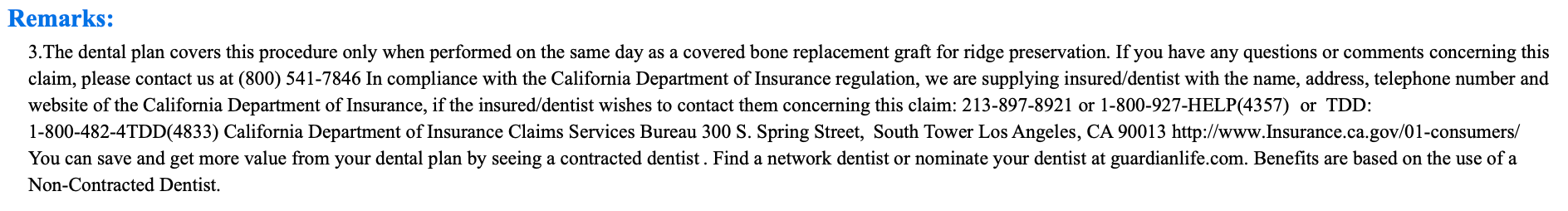

Reading the remarks is the first step to figure out why a denial happened. The plan administrator says they only cover that charge when it happens the same day as a bone graft. Looking back at the three items, item #2 is a bone graft. Looking at the tooth number column, the Bone Graft shows tooth 6, and the Guided Tissue Regeneration (GTR) item show tooth 1. Could my dental surgeon have specified the wrong tooth? Seemed unlikely. I looked over at my receipt from their office.

Looks pretty clear to me. Since the denial remark showed a phone number, I called it. I decided if the hold time was over 5 minutes, I'd abandon that approach and send a message through the portal instead.

After 2 minutes dealing with their IVR, I gave up and said "AGENT" (has anyone had a voice IVR work? I'd love to meet you, leave me a note!). Once transferred, someone picked up immediately and resolved the issue in 3 minutes, confirming their data entry team made the error.

Now, I could get very tin-foil hat and note how beneficial it is for Guardian to have a data entry process that can make an obvious error so easily, or that there isn't a robust process to confirm data entry didn't make an error before issuing a denial.

It took just 15 minutes of effort to review the EOB, check the bill, and make the call. An additional payment for $214 arrived a week later. Effort, minimal; risk, nearly non-existent; result, positive.

Surprisingly, I've had four other similarly simple insurance denials in both the US and Canada. One from an insurance company that denied a claim based on mis-reading a date on a claim form (Pacific Blue Cross), one after just getting new employer coverage when they mis-entered my gender during my account creation (Medavie Blue Cross), one denied reimbursement for a flu shot because I'd "already received one" but they were actually denying because my husband already had his (Providence Health Plan), and one denial because of incorrect data entry of a drug name (Sunlife).

Many denials are going to be just this easy, and are worth your time. When hold times are short, I'll address issues over the phone. When holds times are long or agents are unhelpful, I'll write three paragraphs with my concern and send it via an online portal or email. (If the contact form isn't obvious in the portal searching [insurer] email address or [insurer] contact form should find the right place. If all else fails, you can also mail them a letter, making sure your Member ID and the Claim ID are on it.)

But what if it's harder?

When the reason for denial isn't as clear cut, appealing can be harder. Let's look at another recent partial denial I received (again from Guardian):

Again, we see a situation where the larger charge is being covered, but the smaller charge shows a 0% coverage. Let's look over at the remarks on this one to see what's going on:

This time the remarks say Guardian will only cover a bone graft procedure one time per lifetime, and therefore it's not covered. At first glace that makes sense; and I go to my online portal list of covered services to check because I'd seen no lifetime limits on extractions or implants (something I'd checked when I signed up for this plan, as I knew this work was coming).

Indeed, nothing on my covered services list mentioned limits. But the online version of the benefits guide was incredibly basic; and I wanted to look even deeper. So I went looking for my coverage booklet (or as Guardian calls it, their certificate booklet). I actually wasn't able to find it anywhere online, so made a call to Guardian to request an email copy, which they did quickly. (Again, I believe this book should be very easy to access online, and I could tin foil hat about why it isn't...)

I went through the 68 page booklet and found their section on implants, and saw no such limit mentioned. I then emailed Guardian along with the state insurance commissioner (I was becoming annoyed to be emailing them again), to point this out and ask for coverage.

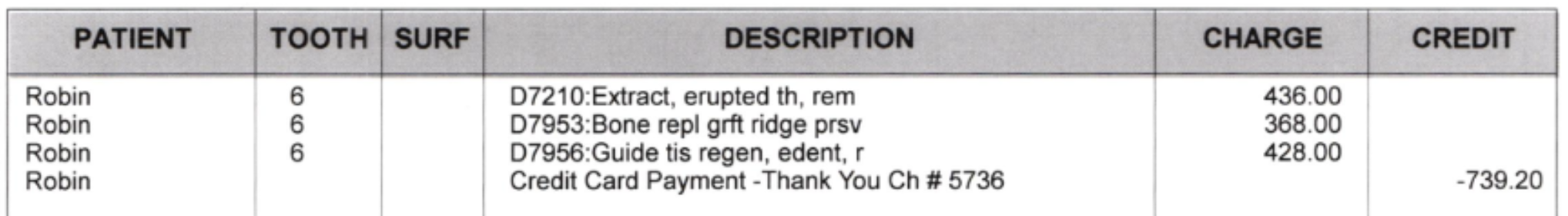

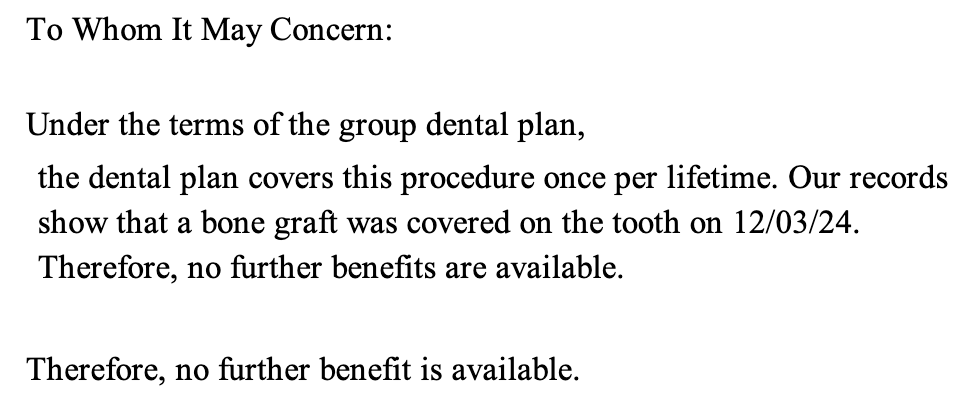

They responded with the same rationale to both me and the state insurance commissioner. So I responded asking for them to share exactly where the limit is in the plan documents. A few days later, a Guardian representative reached back out to let me know they would cover the procedure and the limit wasn't in the policy book.

![This letter is in response to your follow-up complaint regarding our upheld denial of your bone graft to be done with your surgical placement of implant, in the area of tooth 06. As you have correctly indicated, the policy book does not have any wording supporting this frequency denial. As a result, an exception has been made to cover the additional bone graft procedure that is to be done by [redacted] in conjunction with your implant procedure. Your predetermination has been reprocessed to reflect the allowance with the benefit amount of $342.00. We trust that this response addresses your concerns but please contact me directly at the address or numbers provided if you have any further questions.](https://robinmonks.com/content/images/2025/05/image-9.png)

So, how does an insurance company not know what's in their own policy booklet? Actually, pretty easily. Because insurance companies and benefits administrators will have thousands of different policies for different regions, different employers, different levels of coverage, and for even narrower groups. I suspect Guardian has versions of their plan that have this lifetime restriction, and it's even possible my plan should have, but they never put that restriction in writing.

Therefore, for every denial reason, there's value in double-checking. Check your plan documents and make sure the reason they state matches your plan text. Don't assume they interpreted it correctly. If the denial reason isn't clear, reach out and ask for specific details on the denial and the specific entries in the plan documentation that support the denial.

Last, even if the insurer denies your appeal; you can still ask for more details. With Guardian, I don't think they even checked the plan language on my first email, but asking for references means they had to and they noticed their error. Again, the worst case is you end up paying what you're already billed, but the best case is you get coverage.

This back and forth happened over the course of about a month, and took 3 emails on my part. Overall, my time investment was about an hour spread out over that month.

Resources

On this journey, you have help, and there are a lot of resources to help you understand claims denials and write your appeals. If the denial is for only a few dollars, or for thousands of dollars, it's worth taking time to appeal and at a minimum make insurers show their work on how they reach decisions.

An Arm And a Leg

An Arm And a Leg is a great podcast that's worth your time, and they also provide a "First Aid Kit" email toolkit for navigating insurance appeals, getting charity care, choosing the right health plan, and lots of other sticky healthcare topics in the US. Go to their website to check out their show and scroll to the bottom to sign up for the First Aid Kit.

Never Pay the First Bill

The late Marshall Allen's book Never Pay the First Bill has a ton of stories, approaches, and examples of how to fight healthcare bills. It has a deeper dive into medical coding, navigating bureaucracies, understanding pressure points, overturning medical necessity determinations and more. It's a way to give yourself a ton of knowledge and skills on how to get the medical service you deserve.

Fight Health Insurance

Fight Health Insurance has an AI tool that will generate appeal letters for you. I don't use this tool, and when I tried it, the appeal it generated wasn't helpful; however, if you're really not comfortable writing something, it could provide a baseline to assist and may give you good ideas for appealing more complex procedures.

Government Resources

The National Association of Insurance Commissioners lists the contact info for the insurance officials in each US state and territory that's fully up to date. If your insurance company is giving you the run-around, they will often have legal tools to force a response and explanation.